Unlocking the Secrets of Forex Trading Strategies

Forex trading is an exciting and fast-paced market where traders can potentially profit from currency fluctuations. To succeed in this environment, understanding effective trading strategies is crucial. Whether you’re a beginner or an experienced trader, being equipped with the right strategies can be the difference between success and failure. In this detailed article, we will explore various forex trading strategies, specifically tailored to suit different trading styles and risk appetites. For those new to trading, exploring forex trading strategies pdf Trading Brokers in Morocco can also provide valuable insights and resources.

What Are Forex Trading Strategies?

Forex trading strategies are systematic approaches used by traders to make trades on currency pairs. These strategies can be based on technical analysis, fundamental analysis, or a combination of both. The objective is to identify opportunities in the market and determine when to enter and exit trades for optimal profit. Having a well-defined strategy is critical as it helps traders stay disciplined, manage risk effectively, and avoid emotional trading decisions.

Types of Forex Trading Strategies

There are several different categories of forex trading strategies, each with its own methods and objectives. Below are some of the most popular strategies:

1. Day Trading

Day trading involves opening and closing positions within the same trading day. Traders who use this strategy aim to capitalize on short-term price movements. This approach necessitates a good understanding of technical analysis, as traders typically rely on intraday charts and indicators to make quick decisions. Successful day traders must also maintain strong discipline, as emotional reactions can lead to significant losses.

2. Swing Trading

Unlike day trading, swing trading involves holding positions for several days or weeks to capitalize on expected price swings. This strategy is ideal for traders who cannot monitor the markets constantly. Swing traders often use technical analysis to identify entry and exit points and may incorporate fundamental analysis for a more comprehensive view of the market. Risk management is crucial in swing trading, as market conditions can change quickly.

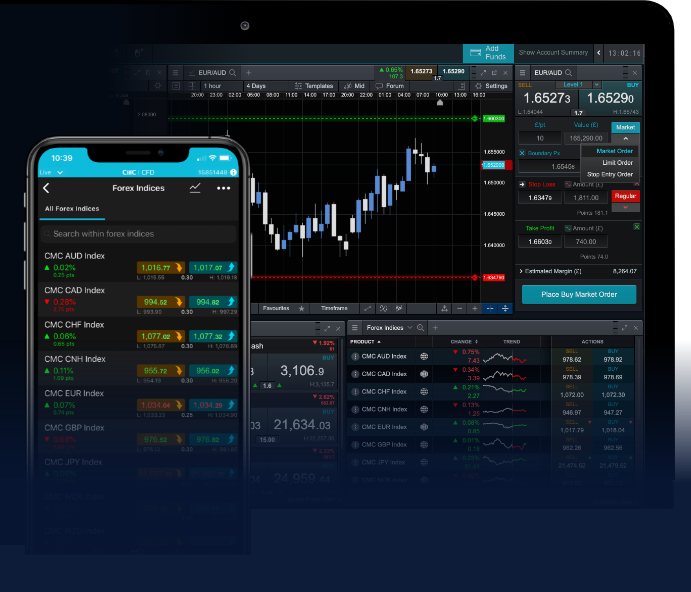

3. Scalping

Scalping is a high-frequency trading strategy where traders make numerous trades throughout the day, aiming to profit from small price moves. Scalpers often rely on technical indicators and very short-term charts to execute their trades, holding positions for mere seconds or minutes. This technique requires a deep understanding of the market’s dynamics, a strong trading platform, and a high level of focus and discipline.

4. Trend Following

This strategy involves identifying and capitalizing on existing market trends. Traders using this method will look for signs that a currency pair is trending either upward or downward and will enter positions that align with that trend. Tools like moving averages and trend lines are commonly employed to determine the direction of the trend. Trend following is based on the belief that “the trend is your friend,” and traders aim to ride the trend until it shows signs of reversal.

5. Range Trading

Range trading involves identifying price ranges where a currency pair is trading and placing buy and sell orders at the support and resistance levels. Traders using this strategy typically look for well-defined price ranges and will buy when the price approaches support and sell when it nears resistance. This strategy works best in a sideways market where price oscillates within a set range, but it can become risky during strong trending conditions.

6. Breakout Trading

Breakout trading focuses on entering trades when the price breaks above key resistance levels or below key support levels. Traders use this strategy to capture significant price movements that often follow breakouts. Successful breakout trading requires good timing, as false breakouts can lead to losses. Many traders use volume indicators to support their breakout decisions, as increased volume typically signifies strong price movement.

How to Develop a Forex Trading Strategy?

Creating an effective forex trading strategy involves multiple steps, including:

- Defining Trading Goals: Clarify your objectives, trading style, and risk tolerance.

- Research and Analysis: Conduct thorough research on currency pairs and market conditions.

- Choosing a Strategy: Select a trading strategy that aligns with your goals and available time.

- Backtesting: Test the strategy against historical data to assess its effectiveness.

- Paper Trading: Practice your strategy in a demo or paper trading environment to build confidence.

- Monitor and Adjust: Continuously evaluate your strategy and make adjustments based on market behavior.

The Importance of Risk Management

No trading strategy can guarantee profits without an adequate risk management plan. Successful traders understand that emotional decisions can lead to losses, and they prioritize the protection of their capital. Key elements of risk management include:

- Setting Stop-Loss Orders: Always determine and place stop-loss orders to limit potential losses on open trades.

- Position Sizing: Manage your position sizes based on your account balance and the risk you’re willing to take on each trade.

- Diversification: Avoid putting all your capital into one or two trades by diversifying your portfolio.

Conclusion

Forex trading can be rewarding, but it is crucial to approach it with a solid understanding of strategies and risk management. Whether you prefer to day trade, swing trade, scalp, or utilize trending strategies, developing and adhering to a method will help you achieve your trading goals. Remember to invest time in education, and never stop refining your trading approach. With the right mindset and strategies, success in forex trading is within your reach.