Forex Trading Strategies for Beginners

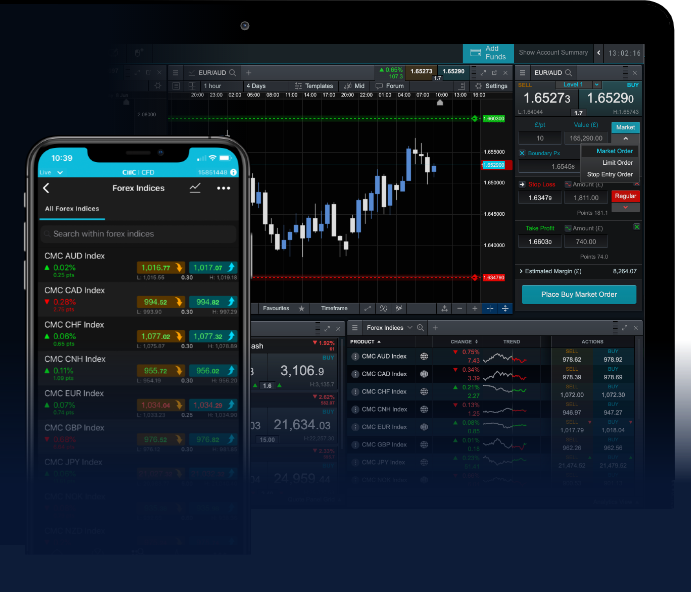

Entering the world of forex trading strategies for beginners Forex Trading Platforms can be both exciting and intimidating. The foreign exchange market (Forex) operates as a decentralized marketplace where currencies are traded, and understanding the fundamental strategies can help you navigate this complex landscape. This article aims to guide you through essential Forex trading strategies tailored for beginners, equipping you with the knowledge to make informed trading decisions.

Understanding Forex Trading

The Forex market is the largest financial market in the world, where trillions of dollars are exchanged daily. Unlike stock markets that operate through exchanges, the Forex market operates over-the-counter (OTC). This means that trading activities occur directly between parties, typically through electronic trading platforms. As a beginner, gaining a solid foundation in how the market works is crucial.

1. Know the Basics

Before diving into complex strategies, it’s important to understand some basic concepts:

- Pips: The smallest price move that a given exchange rate can make based on market convention.

- Currency Pairs: Currencies are traded in pairs, e.g., EUR/USD, where one currency is the base currency and the other is the quote currency.

- Leverage: This allows you to control a larger position than your actual investment, which can amplify both gains and losses.

2. Setting Up a Trading Plan

A well-crafted trading plan is essential for success. It should include:

- Your Goals: Define your financial goals and the amount of time you’re willing to dedicate to trading.

- Risk Management: Determine how much capital you are willing to risk on each trade. A common rule is to risk no more than 1-2% of your trading capital on a single trade.

- Trading Strategy: Identify which trading strategy suits your style (more on this below).

3. Popular Forex Trading Strategies for Beginners

a. Scalping

Scalping involves making numerous trades throughout the day to capture small price movements. This strategy requires a solid understanding of market dynamics and a disciplined approach. Scalpers typically hold positions for seconds to minutes and benefit from high leverage.

b. Day Trading

Day trading is another short-term trading strategy where positions are opened and closed within the same trading day. Day traders rely on market volatility to make profits and avoid overnight risks. This style requires a good grasp of technical analysis and the ability to react quickly to market movements.

c. Swing Trading

Swing trading involves holding positions for several days to take advantage of price trends. This strategy is less time-intensive than day trading and allows traders to analyze market trends over a longer timeframe. Swing traders often use both technical and fundamental analysis to make informed decisions.

d. Position Trading

Position trading is a long-term strategy that involves holding trades for weeks, months, or even years. This approach is suitable for traders who have a deeper understanding of economic indicators and trends, as they are less influenced by short-term market fluctuations.

4. Technical Analysis vs. Fundamental Analysis

Understanding the difference between technical and fundamental analysis is crucial for developing effective trading strategies.

a. Technical Analysis

This method involves analyzing historical price data to forecast future price movements. Traders use various charts and indicators such as moving averages, relative strength index (RSI), and Fibonacci retracements to identify potential entry and exit points.

b. Fundamental Analysis

Fundamental analysis focuses on evaluating the economic, social, and political factors that may influence currency prices. Factors such as interest rates, inflation, and unemployment rates are crucial in determining a currency’s strength.

5. The Importance of Risk Management

Effective risk management is fundamental to Forex trading success. Implementing strategies to protect your capital should always be a priority. Here are some tips:

- Use Stop-Loss Orders: This automated order helps limit potential losses by closing a position when it reaches a certain price.

- Diversify Your Portfolio: Spread your investments across different currency pairs to minimize risk.

- Regularly Review Your Strategies: Analyze your past trades to identify what works and what doesn’t.

6. Continual Learning and Improvement

The Forex market is dynamic, and keeping up with its trends and changes is essential. Here are ways to ensure continual improvement:

- Stay Updated: Follow market news, attend webinars, and read trading books.

- Join Trading Communities: Engaging with other traders can provide valuable insights and diverse perspectives.

- Practice with a Demo Account: Before trading with real money, use demo accounts to practice and refine your strategies without financial risk.

Conclusion

Embarking on a Forex trading journey can be both thrilling and rewarding, provided you approach it with the right strategies and mindset. By understanding the market fundamentals, developing a personalized trading plan, and committing to continual self-improvement, you can enhance your chances of success in the Forex trading landscape. Remember, patience, discipline, and a willingness to learn are key attributes of successful traders. Are you ready to take the plunge and start trading?